Home Equity Can Be a Game Changer When You Sell

Are you on the fence about selling your house? While affordability is improving this year, it’s still tight. And that may be on your mind. But understanding your home equity could be the key to making your decision easier. An article from Bankrate explains:

“Home equity is the difference between your home's value and the amount you still owe on your mortgage. It represents the paid-off portion of your home.

You'll start off with a certain level of equity when you make your down payment to buy the home, then continue to build equity as you pay down your mortgage. You'll also build equity over time as your home's value increases.”

Think of equity as a simple math equation. It's the value of your home now minus what you owe on your mortgage. And guess what? Recently, your equity has probably grown more than you think.

In the past few years, home prices skyrocketed, which means your home's value – and your equity – likely shot up, too. So, you may have more equity than you realize.

How To Make the Most of Your Home Equity Right Now

If you're thinking about moving, the equity you have in your home could be a big help. According to CoreLogic:

“. . . the average U.S. homeowner with a mortgage still has more than $300,000 in equity . . .”

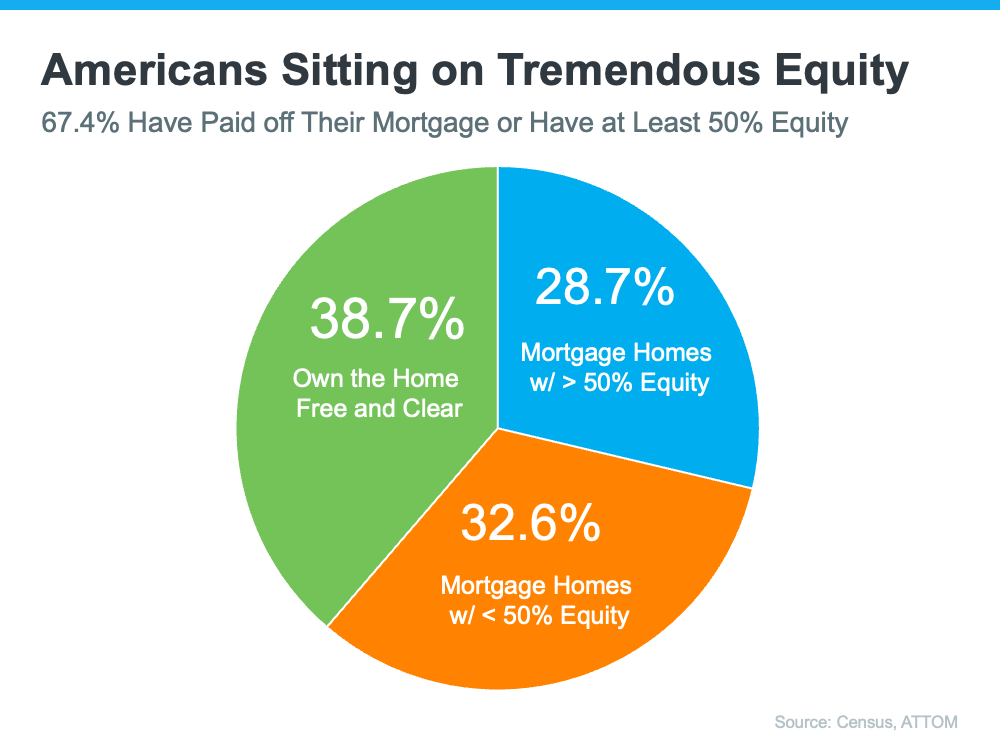

Clearly, homeowners have a lot of equity right now. And the latest data from the Census and ATTOM shows over two-thirds of homeowners have either completely paid off their mortgages (shown in green in the chart below) or have at least 50% equity (shown in blue in the chart below):

That means roughly 70% have a tremendous amount of equity right now.

After you sell your house, you can use your equity to help you buy your next home. Here’s how:

- Be an all-cash buyer: If you’ve been living in your current home for a long time, you might have enough equity to buy your next home without having to take out a loan. If that’s the case, you won’t need to borrow any money or worry about mortgage rates. Investopedia states:

“You may want to pay cash for your home if you're shopping in a competitive housing market, or if you'd like to save money on mortgage interest. It could help you close a deal and beat out other buyers.”

- Make a larger down payment: Your equity could also be used toward your next down payment. It might even be enough to let you put a larger amount down, so you won’t have to borrow as much money. The Mortgage Reports explains:

“Borrowers who put down more money typically receive better interest rates from lenders. This is due to the fact that a larger down payment lowers the lender’s risk because the borrower has more equity in the home from the beginning.”

The Easy Way To Find Out How Much Equity You Have

To find out how much equity you have in your home contact me for your free market analysis to see how much your home is worth.

San Francisco Home Appreciation 2023

Year-over-Year Appreciation: An Overview

The San Francisco real estate market has experienced notable year-over-year appreciation, reflecting the city's ongoing desirability and economic vitality. Condos and single-family houses have seen varying degrees of appreciation, influenced by factors such as location, housing demand, and market trends. Generally, condos in San Francisco have become increasingly popular, especially among first-time homebuyers and those seeking a more urban lifestyle with less maintenance. Single-family houses, on the other hand, continue to attract buyers looking for more space and privacy, a commodity in this densely populated city. The appreciation rates for these property types vary by neighborhood but consistently outpace national averages, underscoring San Francisco's status as one of the most sought-after real estate markets in the country.

Factors Influencing Appreciation

The appreciation of condos and single-family houses in San Francisco's prime neighborhoods is driven by a complex interplay of factors. Understanding these can provide insights into the market dynamics and potential future trends.

-

Economic Factors: San Francisco's economy, buoyed by the tech industry and a diverse range of other sectors, creates a high-income workforce capable of investing in the real estate market. In 2024 the stock market has been strong and we are seeing a surge in buyers this year with homes getting multiple offers.

-

Supply and Demand: The limited availability of land and strict zoning laws in San Francisco restrict the supply of new housing, especially in sought-after neighborhoods like Pacific Heights, Marina, and Nob Hill. This scarcity, combined with high demand, drives significant appreciation. Condos, offering a more accessible entry point into these neighborhoods, have seen particularly high interest, while the demand for single-family houses reflects a desire for space and privacy.

-

Interest Rates: Mortgage interest rates also play a crucial role in real estate appreciation. Lower rates make borrowing more affordable, increasing the number of potential buyers and driving up property values. Conversely, higher rates can cool the market, though San Francisco's market often remains robust due to its unique appeal.

-

Employment Rates: Employment stability and growth in high-paying sectors contribute to the purchasing power of potential buyers. San Francisco's status as a tech hub, in particular, supports a strong job market that bolsters the real estate market.

-

Lifestyle and Amenities: The desirability of a neighborhood, influenced by its lifestyle, amenities, and aesthetic appeal, significantly impacts property values. Neighborhoods offering a mix of urban convenience, natural beauty, and recreational opportunities see higher appreciation rates, as they attract buyers looking for a quality of life that matches their financial investment.

-

Market Trends: Lastly, broader real estate market trends, including national economic indicators and global events, can influence local appreciation rates. San Francisco's real estate market, however, often demonstrates resilience and a capacity for sustained growth, thanks to the city's enduring appeal.

Conclusion and Future Outlook

The San Francisco real estate market, particularly in neighborhoods like Pacific Heights, Presidio Heights, Cow Hollow, Marina, Nob Hill, and Russian Hill, continues to thrive, driven by a combination of economic vitality, limited supply, and a high demand for quality living spaces. Condos and single-family houses in these areas have appreciated significantly year over year, reflecting the city's status as one of the most desirable places to live.

Looking ahead, the market is likely to remain robust, with fluctuations influenced by economic conditions, interest rates, and global events. The enduring appeal of San Francisco's prime neighborhoods, coupled with the city's economic resilience, suggests that real estate here will continue to be a sound investment. Buyers and investors should, however, stay informed of market trends and consider long-term factors influencing appreciation to make strategic decisions.

This analysis underscores the dynamic nature of the San Francisco real estate market, highlighting the unique factors that contribute to the appreciation of condos and single-family houses in some of its most prestigious neighborhoods.